Holding on to the family home more difficult from 2016.

The rental income exemption will cease for new residents entering residential aged care from 1 January 2016.

Income from renting out the former home will no longer be exempt for aged care means testing purposes for people entering care on or after 1 January 2016. Removal of the rental income exemption will increase a person’s assessable income and is likely to result in higher means-tested care fees.

Who will be affected?

People entering residential care for the first time on or after 1 January 2016.

What is changing?

Under current rules, if a person living in permanent residential aged care earns income from renting their former principal residence then that income is exempt from the residential aged care means test. (NB: this only applies to people who pay part of their Refundable Accommodation Deposit (RAD) as a Daily Accommodation Payment (DAP).

This rental income exemption will be removed, meaning that any rental income will be included in a person’s assessable income. This will result in an increase in the means-tested care fee (MTCF) for that person.

Importantly, this change only affects aged care means testing – the exemption remains for Centrelink and Department of Veterans’ Affairs pension purposes. In other words, the amount of Age pension or Veterans’ Affairs service pension payable to the resident will not change.

Case study

Gloria enters care on 15 January 2016. Her assets include her former home valued at $600,000. Net rental income after expenses is $435 per week ($22,620 per year). She also has a bank account with $52,000. Gloria qualifies for the maximum age pension.

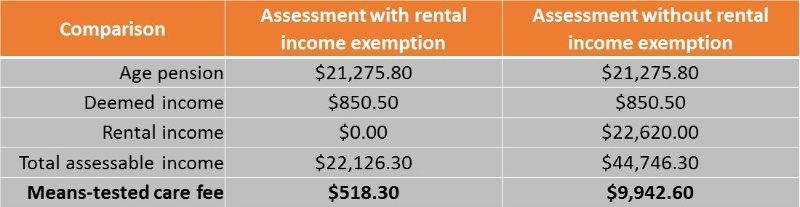

The table below compares total assessable income and then means-tested care fee, with and without the rental income exemption.

As a result of removing the rental income exemption, Gloria’s assessable income increases by $22,620 per year. It also increases her means-tested care fee by $9,424.30 per year.

If Gloria entered residential care before 1 January 2016, she would have qualified for the rental income exemption and been liable to pay the lower amount of means-tested care fee.

Note that as long as Gloria enters care before 1 January 2016, the rental income exemption will apply even if she does not rent out her former home until after 1 January 2016.

Conclusion

People planning to enter residential care in early 2016 should consider the impact of losing the rental income exemption. If a person will be worse off as a result of the change then earlier admission should be considered in order to take advantage of the rental income exemption.